Penny stocks often stir up curiosity—and for good reason. These shares, typically priced under $5, belong to smaller companies with big growth potential. Sure, they’re risky, but when they pay off, they can transform a modest investment into something extraordinary.

Two penny stocks currently catching Wall Street’s attention are Intellia Therapeutics (NTLA) and Cabaletta Bio (CABA). Analysts predict these biotech companies could see gains ranging from 306% to an astonishing 1,183% by 2025. Let’s unpack why these stocks are turning heads.

Why Biotech Penny Stocks?

Biotech penny stocks are no stranger to wild price swings. While these companies often lack approved products, their success hinges on breakthroughs in clinical trials. A single FDA approval can send shares soaring.

Take the AI boom earlier this year—stocks in that sector climbed as much as 600%. Biotech stocks, particularly those in drug development, have similar potential to explode when promising trial results roll in.

#1: Intellia Therapeutics (NTLA)

What They Do

Intellia Therapeutics focuses on CRISPR/Cas9 gene editing technology to treat genetic disorders. With a market cap of $1.4 billion, the company develops both in vivo (inside the body) and ex vivo (outside the body) therapies to target specific diseases.

Recent Progress

Though the stock has dipped by 51.3% this year, Intellia has made significant advancements:

- NTLA-2001: Their flagship treatment for transthyretin amyloidosis (ATTR) is in Phase 3 trials. Early results have been promising.

- NTLA-2002: Designed for hereditary angioedema, this treatment is also advancing through Phase 3 trials.

- NTLA-3001: Aimed at alpha-1 antitrypsin deficiency, trials are set to begin soon.

Despite the setbacks in share price, the company’s robust cash reserve of $944.7 million ensures operations are funded through 2026, giving it plenty of runway to advance its pipeline.

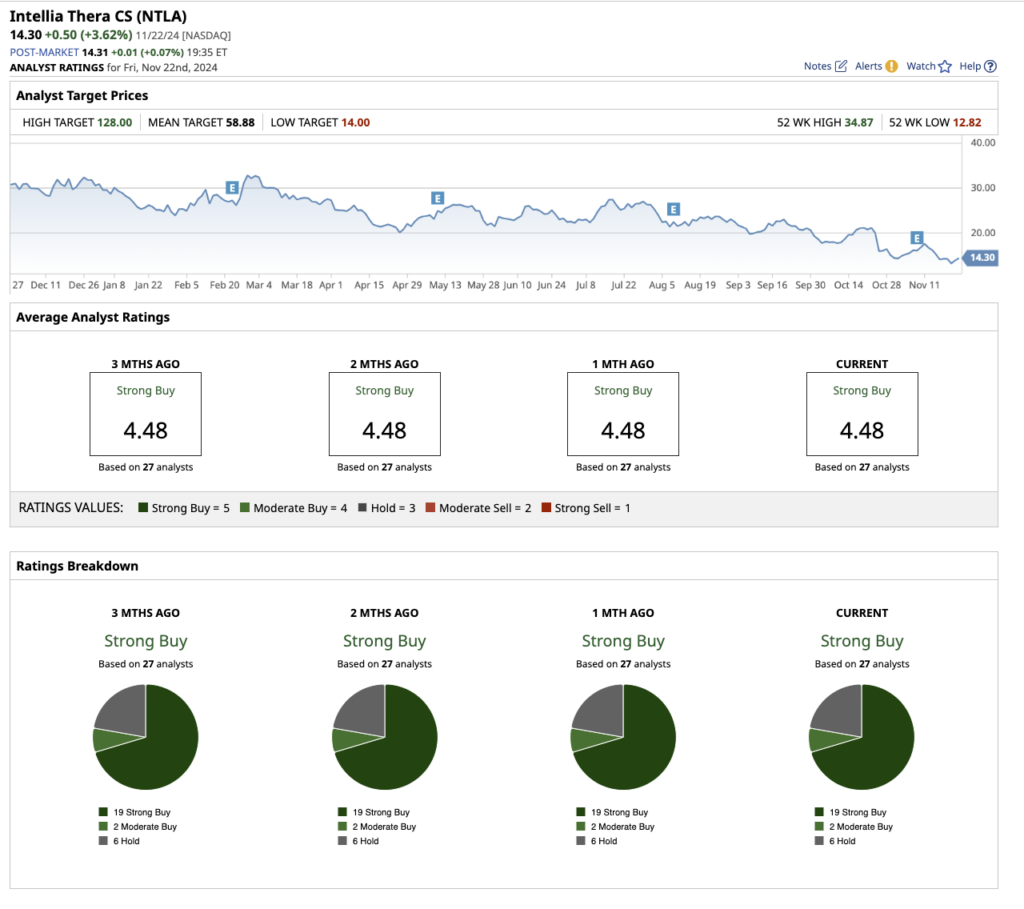

Wall Street’s Take

Analysts are bullish. Of 27 covering the stock:

- 19 rate it a “strong buy.”

- Average price target: $58.80, reflecting a 306% upside.

- Some go even higher, with top estimates at $128 per share.

Read More: Warren Buffett Sells 3 Major Stocks: What’s Behind the Move?

#2: Cabaletta Bio (CABA)

What They Do

With a smaller market cap of $91.4 million, Cabaletta Bio specializes in cell therapies for autoimmune diseases. Their lead candidate, CABA-201, is showing promise in treating:

- Systemic lupus erythematosus (SLE)

- Systemic sclerosis (SSc)

- Myositis

Expanding Horizons

Cabaletta isn’t just sticking to the U.S. market:

- Trials now span 40 locations nationwide.

- The European Medicines Agency approved CABA-201 for lupus trials, opening doors to European markets.

Financial Stability

With a cash position of $183 million, Cabaletta is well-equipped to fund operations until mid-2026. This stability gives it the flexibility to scale clinical trials and expand internationally.

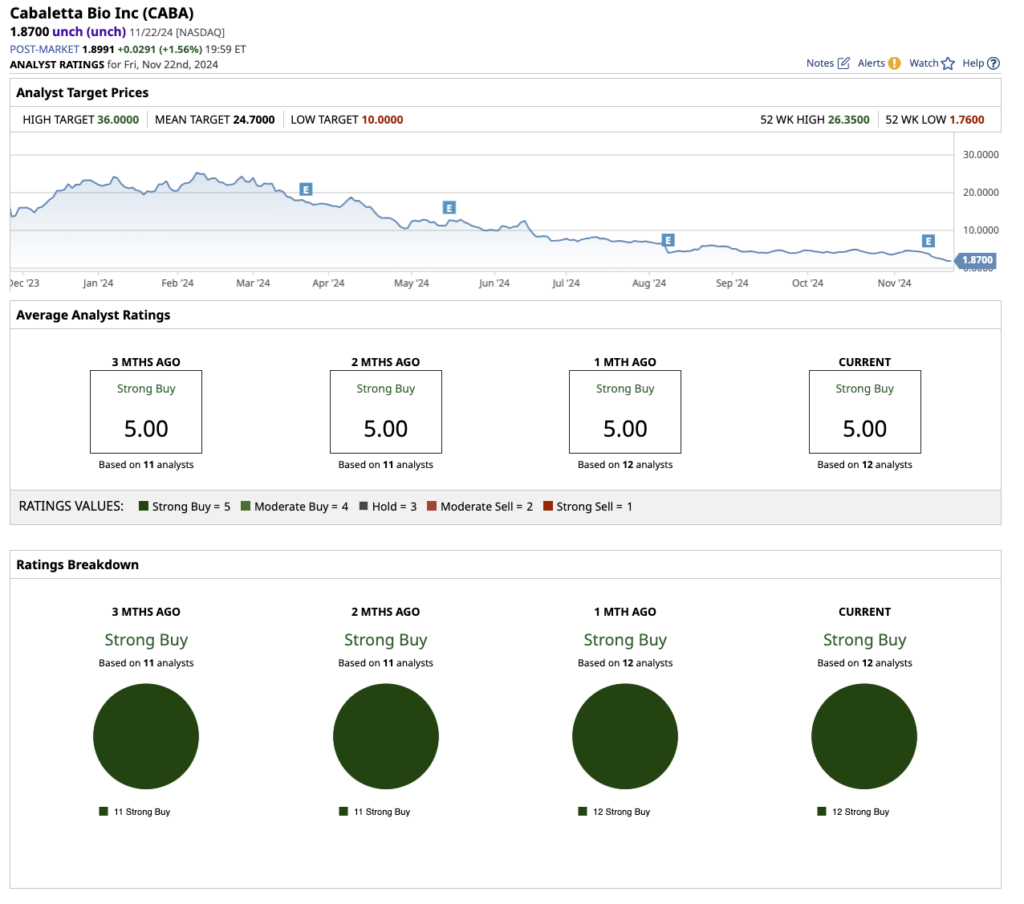

Wall Street’s Take

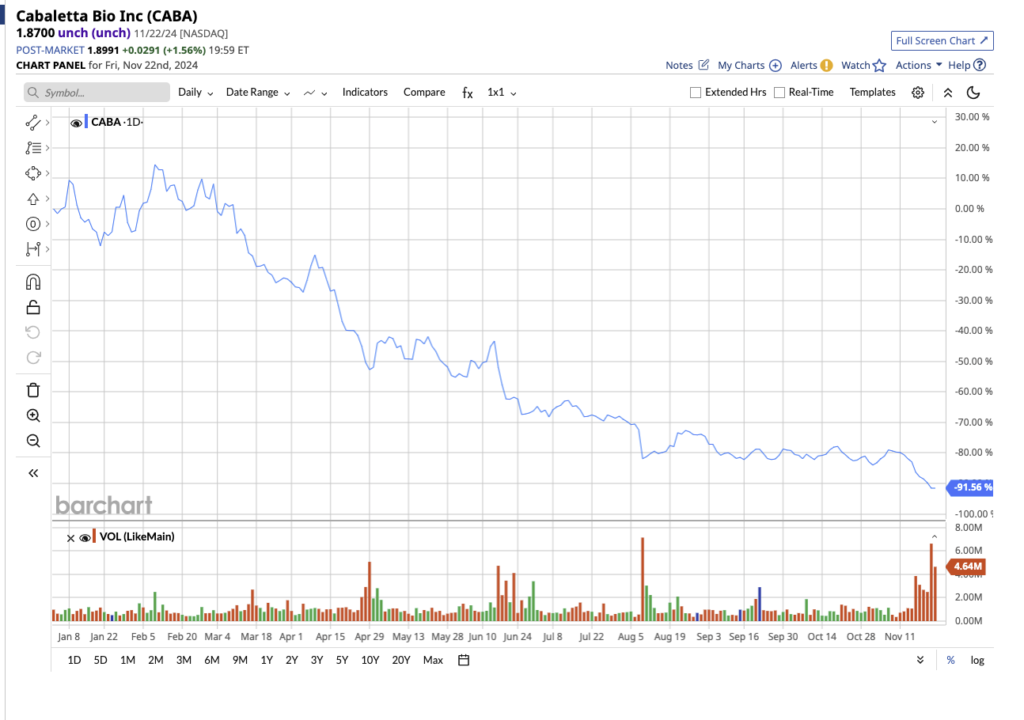

Cabaletta is a sleeper hit:

- All 12 analysts covering the stock rate it a “strong buy.”

- Current price: $1.87 per share.

- Average target: $24.70, implying a staggering 1,183% upside.

Risks to Keep in Mind

Let’s not sugarcoat it—investing in penny stocks comes with its own set of risks:

- Regulatory Hurdles: FDA approval is far from guaranteed.

- Clinical Trial Failures: One poor result can sink a stock overnight.

- Volatility: Prices can swing wildly, so buckle up.

These stocks are best suited for high-risk-tolerant investors who understand the gamble.

Should You Jump In?

Intellia and Cabaletta represent two sides of the biotech coin: a larger, established player and a smaller, nimble innovator. Both are tackling diseases with huge market potential.

While the upside is undeniably attractive, remember: these predictions are just that—predictions. Before investing, consider your financial goals and risk tolerance.

The Bottom Line

Penny stocks like Intellia Therapeutics and Cabaletta Bio showcase the allure of biotech investments: high risk, but potentially sky-high rewards. With Wall Street analysts firmly in their corner, these companies are worth watching as they march toward 2025.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. Always conduct your own research or consult a financial advisor before making investment decisions.