The crypto world is bracing for turbulence as the European Union’s (EU) Markets in Cryptoassets (MiCA) regulation takes center stage. With stablecoin giant Tether’s USDT set to be delisted across EU platforms by December 30, concerns are mounting about its potential to weaken Europe’s digital asset appeal. Meanwhile, the U.S., under crypto-enthusiast Donald Trump, gears up for what some call a crypto boom.

MiCA’s Game-Changing Regulations

MiCA aims to tighten oversight in the crypto space, targeting stablecoins like USDT with stringent requirements. Issuers must obtain an e-money license, hold significant reserves with independent banks, and monitor all payment-related transactions. Tether, the largest stablecoin issuer, has yet to secure this license, leaving exchanges with no choice but to drop USDT by the year’s end.

While the regulations promise enhanced transparency and crime prevention, critics argue that they could stifle liquidity and innovation in EU markets. “I understand why it’s been done to a certain extent, but it’s quite exclusionary,” said Usman Ahmad, CEO of Zodia Markets, highlighting USDT’s unrivaled liquidity.

The Ripple Effect on Liquidity

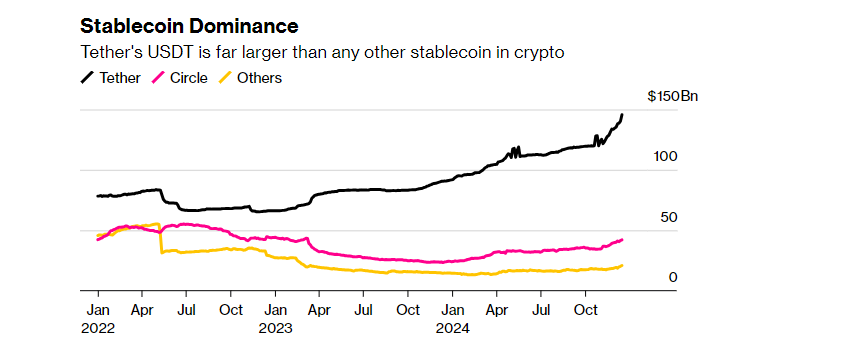

USDT dominates the stablecoin market, far outpacing competitors like Circle’s USDC. Removing it from EU platforms could disrupt trading, with investors needing to navigate less liquid alternatives or rely on fiat trading pairs. “A vast proportion of cryptoassets trade in a pair against Tether’s USDT,” said Pascal St-Jean of 3iQ Corp. This reshuffle could drive up costs and complexity for traders.

Some exchanges, like OKX, have already adjusted, with users transitioning to fiat pairs. However, as Erald Ghoos, OKX’s Europe CEO, noted, the shift has been surprising and not without challenges.

Honored to have a seat at the table. pic.twitter.com/KvK0XyEdYZ

— Kris | Crypto.com (@kris) December 17, 2024

Stablecoins: A Critical Tool

Stablecoins serve as the backbone of crypto trading. Pegged to assets like the dollar or euro, they offer traders a stable medium for moving funds, settling transactions, and even trading traditional assets like bonds. They’ve also gained traction for cross-border payments and cost-efficient digital transactions.

But their rise hasn’t been without scrutiny. Authorities warn that stablecoins, particularly USDT, are frequently used for illicit activities. A UK investigation earlier this year revealed Russian networks using USDT to move billions for criminal enterprises.

Tether has vehemently denied such claims, stating it is committed to combating illegal activity. Yet, EU regulators remain firm, emphasizing the need for stricter oversight.

Europe Risks Falling Behind

As Europe clamps down, the U.S. prepares for a more lenient approach. Trump’s election sparked a crypto frenzy, propelling Bitcoin past $100,000 and reviving interest in speculative tokens. Investors are optimistic about a light regulatory environment, bolstered by Trump’s appointment of crypto-friendly officials like Howard Lutnick to key positions.

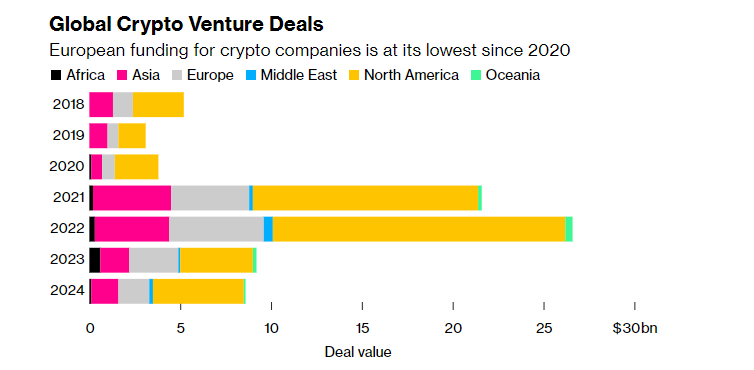

Meanwhile, Europe faces a slowdown. Venture capital investment in EU crypto startups is at a four-year low, while North America sees a recovery. A European Central Bank (ECB) report shows crypto ownership in the eurozone has doubled since 2022, but the ECB itself questions the accuracy of this data, calling adoption rates “comparably low.”

The Path Forward

Despite the challenges, MiCA is a pivotal step in creating a safer, more transparent crypto market. However, critics argue it must strike a balance between regulation and innovation to keep Europe competitive. Upgrading surveillance tools and fostering collaboration between regulators and issuers will be crucial.

As Tether considers its next move, including the possibility of securing an e-money license, the global crypto community watches closely. Will Europe’s regulatory gamble pay off, or will it drive traders and innovators elsewhere?

Stay Informed and Engaged

The crypto landscape is evolving rapidly. Whether you’re an investor or an enthusiast, understanding these shifts is key. Subscribe for updates and share your thoughts—how do you see these regulations shaping the future of crypto? Let’s discuss!

Wall St. Is at It Again, Making Irrelevant Market Predictions