Bill Smead, manager of the Smead Value Fund (SMVLX) investor , has issued a stark warning: the stock market is in a bubble, and the consequences of its unwinding will be severe. “The punishment for being on the wrong side of this trade is going to be very substantial,” he said. “People are going to lose a lot of money in the stock market over the next 2-3 years.”

Rising Rates and Defying Gravity

Despite rising 10-year Treasury yields, which have climbed toward 5%, growth stocks and large caps continue to soar. The stock market, Smead argues, “has ignored what has happened to the price of money.”

Smead pointed out that rates have risen, yet the market has delivered back-to-back annual gains of 20%. “It’s like defying gravity,” he said.

The rally gained momentum in the second half of 2024 after the Federal Reserve cut rates by 100 basis points. However, with inflation remaining near 3% and the labor market strong, investors are beginning to realize that rates may stay elevated. Since September, 10-year Treasury yields have risen from 3.6% to 4.6%, even as the Fed eased its benchmark rate.

The Impact of Elevated Valuations

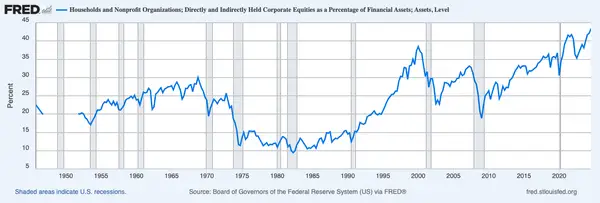

Stock valuations remain at historic highs. The S&P 500’s forward 12-month price-to-earnings ratio is 21, while the Shiller CAPE ratio stands at 37, among its highest levels ever. Household equity ownership has also reached unprecedented levels, with nearly 45% of household assets now in equities, according to St. Louis Fed data.

Smead noted that the outperformance of growth stocks has created a vicious cycle, further driving up valuations. As these stocks perform well, they attract more investment, which in turn fuels additional gains.

Lo & Sons Original Catalina Deluxe Premium Canvas Duffel Bag – Travel, Gym, Hospital, or Weekender Bag with Shoe Compartment for Men and Women

A Divergence from Wall Street Optimism

Smead’s warning stands in stark contrast to Wall Street’s optimistic forecasts. The median year-end target for the S&P 500 in 2025 is 6,600, with strategists predicting over 11% returns this year.

But concerns about a correction are mounting. Goldman Sachs strategists recently noted that while they expect equity markets to make progress in 2025, they are increasingly vulnerable to corrections driven by rising bond yields or disappointing economic data.

The Role of Rising Rates

Higher interest rates pose a significant risk to growth stocks, which rely on long-term projections. Rising yields on 10-year Treasurys make fixed-income investments more attractive, potentially pulling money away from equities.

“For the foreseeable future, market corrections are more likely to come from higher rates rather than weaker economic growth,” said Michael Kantrowitz, chief US equity strategist at Piper Sandler.

The Early Stages of a Bubble Unwinding

Smead believes the unwinding of the stock market bubble is already underway and will play out over the next few years. He joins other prominent investors, such as GMO cofounder Jeremy Grantham and Research Affiliates cofounder Rob Arnott, in warning of a larger unraveling.

“The punishment is going to be incredible,” Smead emphasized. “The punishment for being on the wrong side of this trade is going to be very substantial.”