Gold and silver have long been champions of financial stability, especially during inflationary periods. But silver is now taking center stage, and for good reason.

Unlike gold, silver’s value isn’t just tied to its rarity or allure—it’s deeply woven into the fabric of modern industry. From electronics to healthcare, silver’s real-world applications are expanding rapidly. According to U.S. News & World Report, this industrial demand makes silver a unique hedge against inflation and economic uncertainty.

The Case for Silver: A Scarcity That Drives Value

Jared Walker, owner of Fluidic Metals, emphasizes the growing scarcity of silver. “People should believe in silver’s value because of its real-world use cases. The more consumed by industry—particularly tech—and individual investors, the less availability we’ll see on the market. This will drive value upwards,” he told GOBankingRates.

Translation? As industries gobble up silver, the supply shrinks, which could push prices sky-high.

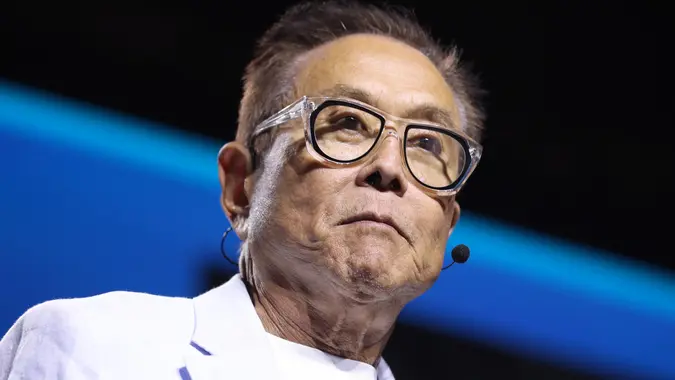

Robert Kiyosaki’s Take: Buy Silver Before It’s Too Late

Robert Kiyosaki, the financial guru behind Rich Dad, Poor Dad, has been sounding the alarm on silver for years. Recently, he took to social media to double down on his bullish stance:

“I HATE to say this…. But the banking crash Jim Rickards, Jim Rogers, Ray Dalio, and I have been warning you about has started. Even if you have very little money, you may still be able to profit from this crash. All you need is a few extra dollars… because you can still afford to buy a few real silver coins… before silver double[s] and triple[s].”

Kiyosaki’s predictions aren’t new. In 2022, he boldly forecasted silver reaching $100 to $500 per ounce. While that didn’t happen, silver’s performance in 2024 has been impressive, climbing to $30.57 per ounce as of December 16.

A Modest Investment That Pays Off

Walker offers a practical perspective on silver as an investment. He suggests swapping impulse purchases for silver bullion. “Every time, let’s say, you place a take-out order for one person, that’s at least a half-ounce of silver you could have in your safe,” he said.

Instead of cluttering your home with gadgets or splurging on fleeting luxuries, consider silver as a tangible asset that can secure your financial future. “I believe everyone deserves to hold assets, no matter who you are or how much money you have,” Walker added.

Is Silver Right for Your Portfolio?

Investing in silver isn’t just about owning shiny coins. It’s a way to diversify your portfolio and hedge against market volatility. However, not everyone agrees that physical bullion is the best route.

Robert R. Johnson, a finance professor at Creighton University, suggests an alternative: “During times of market turmoil, one always hears about investing in gold. While precious metals are a wise way to diversify, it may be better to hold positions in the equities of precious metals firms rather than purchase physical bullion.”

Final Thoughts: Start Small, Think Big

Silver’s affordability makes it an accessible entry point for new investors. Even a small purchase—just a few ounces—can serve as a stepping stone toward financial security.

So, the next time you’re tempted to splurge on takeout or a trendy gadget, consider investing in a tangible asset like silver. Not only is it a smart hedge against economic uncertainty, but it’s also a step toward building a more secure financial future.

Ready to start investing? Take the first step and make your money work for you.