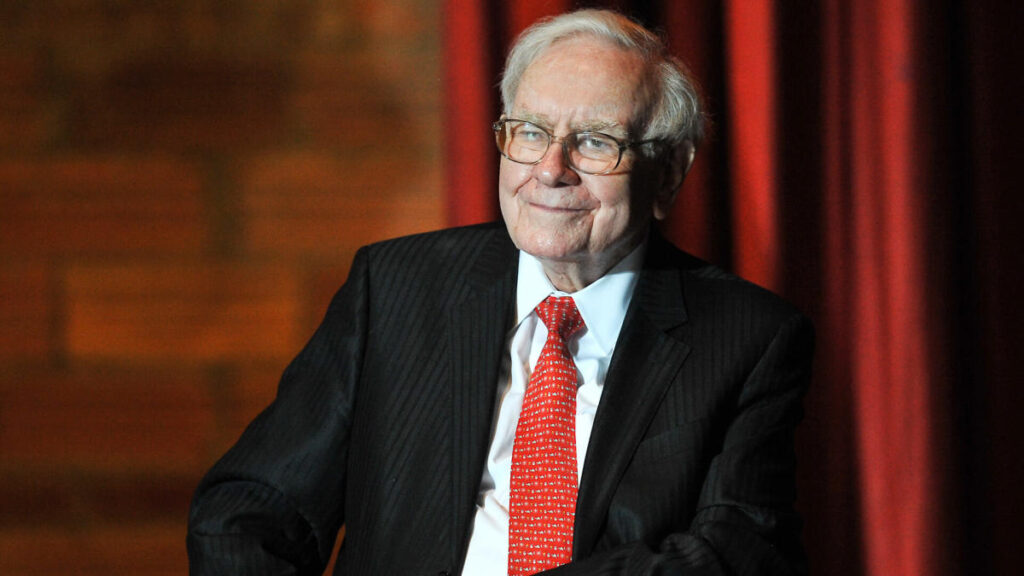

The U.S. has been navigating turbulent economic waters, with inflation hitting 40-year highs since the COVID-19 pandemic. While the situation has improved — inflation as of November 2024 stands at 2.7%, a significant drop from the 9.1% peak in June 2022 — the threat of inflation is never truly gone. Enter Warren Buffett, the “Oracle of Omaha,” with his time-tested advice on how to safeguard your wealth.

Buffett, the legendary CEO of Berkshire Hathaway, is no stranger to navigating financial storms. With an estimated net worth of $142.3 billion as of December 2024, he has consistently championed strategies that work in both good times and bad. So, what are his two best investments to beat inflation?

1. Invest in Yourself

“Whatever abilities you have can’t be taken away from you. They can’t actually be inflated away from you,” Buffett declared during the 2022 Berkshire Hathaway annual meeting. “The best investment by far is anything that develops yourself, and … it’s not taxed.”

Inflation might erode the value of money, but it can’t touch the value of your skills. Whether you’re honing a trade, mastering a craft, or developing expertise in a high-demand field, your skillset is your greatest hedge against inflation. Skills remain relevant and in demand, regardless of the economic climate.

Buffett’s advice underscores the importance of continuous learning and self-improvement. He believes that investing in yourself not only enhances your earning potential but also provides a sense of security that no market fluctuation can take away.

2. Real Estate: A Tangible Asset with Lasting Value

Buffett also emphasizes the enduring value of real estate as an investment. Unlike stocks or cryptocurrency, real estate is a tangible asset, making it less susceptible to the whims of the market.

“They’re the businesses that you buy once and then you don’t have to keep making capital investments subsequently,” Buffett explained during a Berkshire Hathaway shareholders meeting. Real estate doesn’t require constant reinvestment to combat inflation, unlike other assets. This stability makes it a reliable choice during inflationary periods.

Moreover, real estate often appreciates over time, offering both immediate utility and long-term financial growth. Whether it’s residential properties, commercial buildings, or land, real estate remains a cornerstone of Buffett’s inflation-beating strategy.

Why Buffett’s Advice Matters

Warren Buffett’s insights are grounded in decades of experience and success. His strategies are not about chasing trends but about building lasting value. By focusing on personal development and tangible investments like real estate, Buffett provides a blueprint for financial resilience.

Take Action: Build Your Inflation-Proof Strategy

As inflation ebbs and flows, the key is to prepare rather than react. Take a page from Buffett’s playbook: invest in yourself and explore the stability of real estate. These strategies are not just about surviving inflation but thriving in its midst.

What will your next move be? Start by identifying skills you can develop or opportunities in the real estate market. The best time to invest in your future is now.