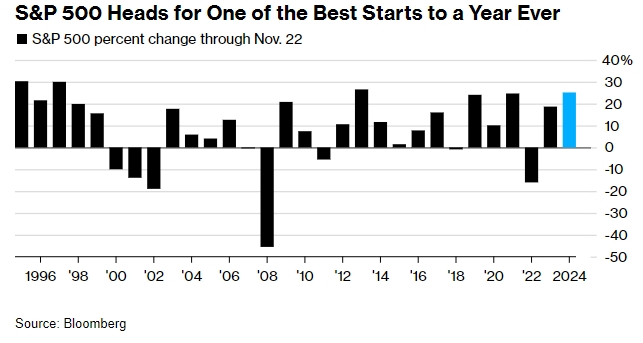

Investors are grappling with the challenge of betting on the traditional stock market rally that often follows a presidential election. However, with the S&P 500 Index set for one of its best starts to a year in history, relying on historical trends may no longer be an effective strategy.

Historical Patterns and Current Challenges

Buying U.S. stocks after an election has long been a reliable trading strategy. Historically, the S&P 500 delivers a median return of 5% from Election Day in November through the year’s end, according to Deutsche Bank AG data. Even small-cap companies, typically among the riskier investments, tend to benefit from this post-election market boost.

Yet, 2024 is anything but a typical election year. The S&P 500 has surged 25% so far, following a 24% jump in 2023. These back-to-back annual gains exceeding 20% have not occurred since the late 1990s. As a result, the S&P 500 now trades at over 22 times projected 12-month earnings, significantly higher than the decade-long average of 18. Additionally, traders are heavily invested in equities, leaving limited room for further upside.

Eric Beiley, executive managing director of wealth management at Steward Partners, explained, “With valuations elevated and the S&P 500 already near 6,000, the market will creep higher from here. But I don’t see a big year-end rally because rising yields will keep investors at bay.”

Elevated Yields and Federal Reserve Hesitancy

The Federal Reserve has reduced interest rates twice since September, but officials have signaled no rush for additional cuts. Meanwhile, Treasury yields have climbed to multi-month highs. President-elect Donald Trump’s victory has fueled speculation about economic policies, including tariffs and mass deportations, potentially driving inflation higher and limiting the Fed’s capacity for rate reductions.

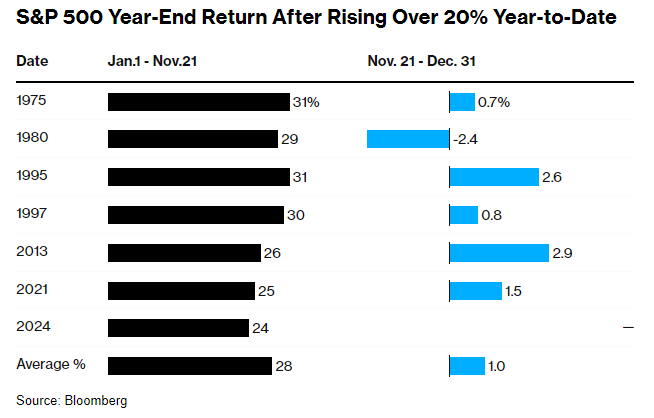

The mixed signals have prompted Wall Street strategists to lower expectations for further rate cuts. Rising borrowing costs have also impacted traditionally strong post-election periods. Historically, while the six months from November to April are the most favorable for U.S. equities, years with S&P 500 gains exceeding 20% show far more muted returns for the remainder of the year—averaging just 1% since the 1970s, according to Bloomberg data.

Read More: Ukraine’s President Zelenskiy switches rhetorical tack from victory to resistance

Market Sentiment and Positioning

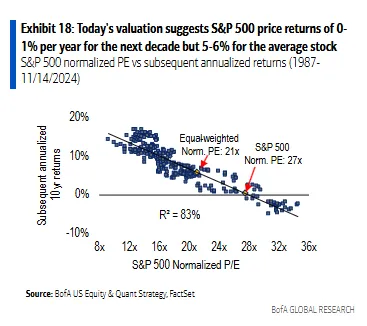

The current rally has left market sentiment “dangerously bullish,” wrote Savita Subramanian, Bank of America’s head of U.S. equity and quantitative strategy, in a recent note. “Sentiment and positioning based on at least five indicators have grown dangerously bullish, leaving less room for positive surprises.”

Concerns about higher borrowing costs have spurred increased demand for hedging through far out-of-the-money put options on indexes like the S&P 500, Nasdaq 100, and Russell 2000. According to Kevin Brocks of 22V Research, these levels of hedging activity mirror the heightened volatility seen before the election.

Signs of Broadening Gains

Despite these risks, optimism persists among investors. U.S. equities saw $16.4 billion in inflows during the week ending November 20, marking the seventh consecutive week of positive flows, according to a Bank of America report citing EPFR Global data.

Broadening market participation is an encouraging sign, with the S&P 500 Equal Weight Index outperforming the traditional market-cap-weighted version since Election Day. Financials, energy, and consumer discretionary stocks have led the way, signaling that gains are spreading beyond megacap tech stocks, which have largely driven recent rallies due to artificial intelligence enthusiasm.

Risks Loom from the Bond Market

However, the bond market remains a critical factor in the equation. If Treasury yields remain elevated and the Fed refrains from further cuts, the equity market may struggle to deliver significant year-end gains.

“A broadening rally is crucial, but the one thing standing in the way of a strong advance for stocks the rest of the year is the bond market,” noted Jamie Cox, managing partner at Harris Financial Group. “That may ultimately put a lid on a hefty year-end rally.”

This article is based on reporting by Jess Menton and Alexandra Semenova of Bloomberg.

Leave a Reply