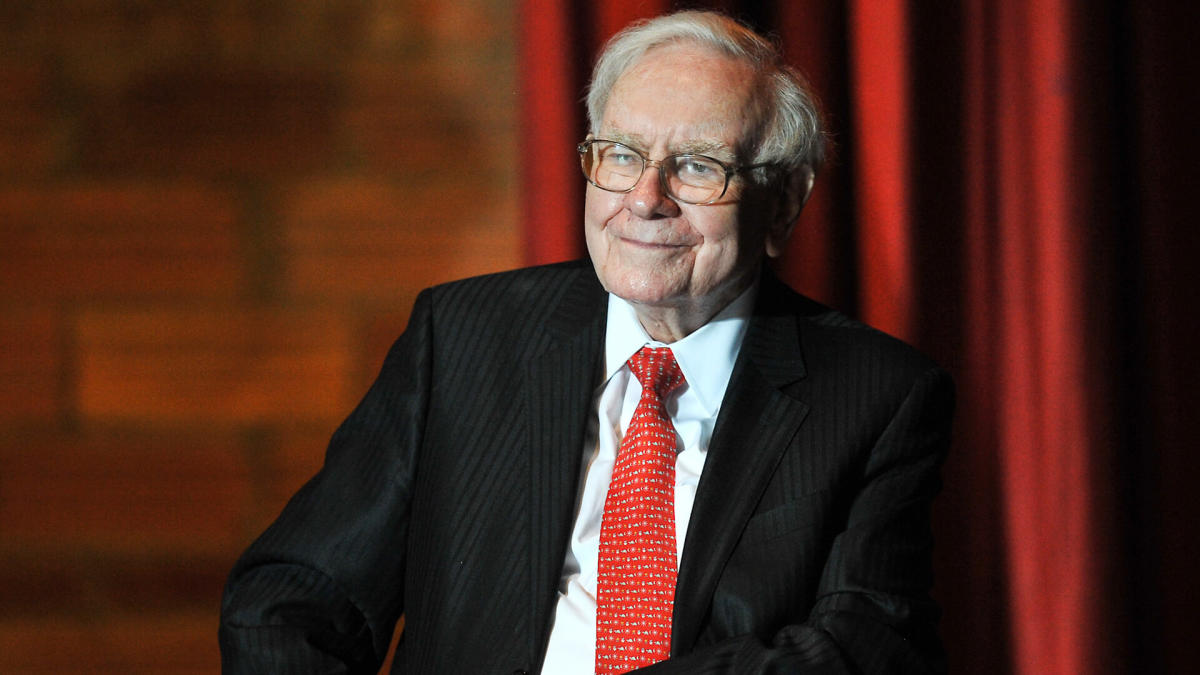

Warren Buffett isn’t as bullish on stocks as he once was. In fact, the “Oracle of Omaha” has been a net seller for eight consecutive quarters. But this year, Buffett has made a significant move by investing $2.9 billion into a single stock.

So, what stock captured Buffett’s attention in 2024, and does it deserve a spot in your portfolio? Let’s break it down.

Buffett’s Biggest Investment of 2024

If you think $2.9 billion is pocket change for Warren Buffett, think again. Only 15 positions in Berkshire Hathaway’s (NYSE: BRK.B) portfolio are worth more than that. Of those, Buffett trimmed his holdings in three and avoided buying more shares in nine others this year.

Notably, he added to positions in Occidental Petroleum, Chubb Limited, and Sirius XM Holdings. However, none of these purchases came close to $2.9 billion.

So, where did the money go? Buffett invested it into Berkshire Hathaway itself through stock buybacks.

Why Buffett Is Buying Back Berkshire Stock

Berkshire Hathaway’s remarkable performance is no secret. Between 1964, when Buffett took control, and 2023, the company delivered an overall gain of 4,384,748%—140 times the return of the S&P 500 during the same period.

This stellar track record alone, however, isn’t the reason behind the buybacks. According to Berkshire’s filings with the SEC, the conglomerate repurchases its stock when Buffett believes the price is below its intrinsic value, conservatively determined.

No one knows Berkshire’s worth better than Buffett. His decision to spend billions on buybacks in 2024 reflects his confidence in the stock’s value at the time of purchase.

Is Berkshire Hathaway a No-Brainer Buy Right Now?

Here’s the catch: Warren Buffett stopped repurchasing Berkshire shares in the third quarter of 2024. The bulk of the buybacks—$2.6 billion—occurred in the first quarter. Since then, Berkshire’s stock price has climbed more than 10%.

Warren Buffett no longer appears confident the stock is undervalued. If he’s cautious, should other investors be?

While Berkshire might not be a screaming buy at its current price, the company remains a powerhouse for the long term:

- Insurance businesses: Generate steady cash flow.

- Energy ventures: Positioned for growth.

- Manufacturing subsidiaries: Produce essential goods.

- Investment portfolio: Now more diversified, thanks to reduced stakes in Apple and Bank of America.

- Cash reserves: A record $325 billion in cash and equivalents, giving Buffett plenty of “dry powder” for future investments.

Berkshire Hathaway may not be a no-brainer buy today, primarily because Buffett himself doesn’t think so at current prices. But with its diversified portfolio, strong cash position, and robust business segments, it’s hard to bet against Berkshire for the long haul.

As Warren Buffett moves suggest, timing and valuation are everything. His strategy offers a valuable lesson for investors: patience pays off.

Netherlands Suspends Schengen Agreement, Brings Back Hard Borders